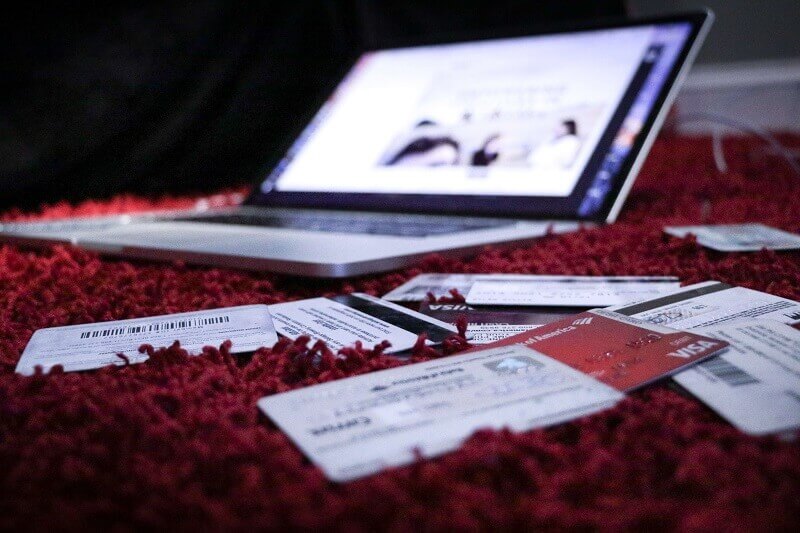

Your credit score plays a pivotal role in your financial life, influencing your ability to secure loans, credit cards, and even rent an apartment. Yet, many people find the world of credit scores mysterious and confusing. In this article, we will unravel the complexities of credit scores, providing you with valuable insights and strategies to boost your creditworthiness.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. Lenders use this score to assess your risk as a borrower. The higher your score, the more likely you are to be approved for loans and offered favorable interest rates.

Factors That Impact Your Credit Score

Your credit score is influenced by various factors, including your payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Understanding how each of these elements affects your score is crucial for improving it.

Managing Your Payment History

The most significant factor affecting your credit score is your payment history. Consistently paying bills on time and in full is essential for maintaining a positive credit history. Late payments, collections, and charge-offs can significantly damage your score.

Optimizing Credit Utilization

Credit utilization refers to the percentage of your available credit that you’re using. To maintain a healthy credit score, aim to keep your credit utilization below 30%. High balances relative to your credit limit can negatively impact your score.

Building a Strong Credit History

The length of your credit history is another crucial factor. The longer your credit accounts have been open and active, the better it is for your score. Avoid closing old accounts, as they contribute positively to your credit history.

Strategies for Elevating Your Credit Score

To improve your credit score, focus on paying bills on time, reducing credit card balances, and disputing any inaccuracies on your credit report. Additionally, avoid opening too many new credit accounts in a short period, as it can lower your score.

Conclusion

In conclusion, your credit score is a vital aspect of your financial life that can impact your access to credit and borrowing costs. Understanding the factors that influence your credit score and implementing strategies to improve it is essential for achieving your financial goals. By diligently managing your payment history, credit utilization, credit history length, and overall credit profile, you can elevate your credit score and open doors to more favorable financial opportunities. Take charge of your credit score, and it will serve as a valuable asset on your financial journey.